Bayridge has Staged the Option to Earn up to 80% Interest in both properties for $10M Exploration Spend

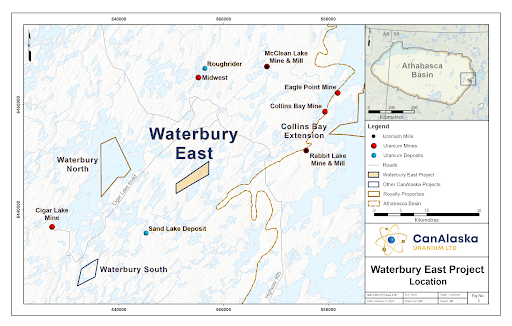

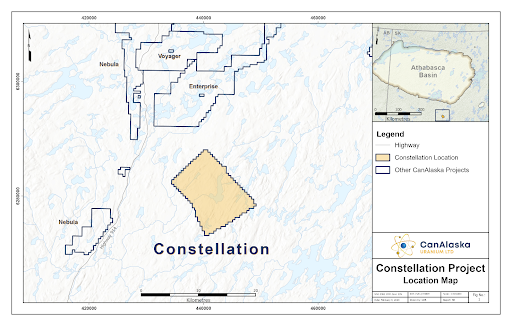

Focus on Tier 1 Eastern Athabasca Basement and Unconformity Uranium Targets Close to Infrastructure

Vancouver, Canada, February 14, 2024 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQX: CVVUF; Frankfurt: DH7) (“CanAlaska” or the “Company”) is pleased to announce that is has entered into Letters of Intent (“LOI”) dated February 9, 2024 with Bayridge Resources Corp. (“Bayridge”) to allow Bayridge to earn up to a 80% interest in each of the Waterbury East and Constellation Projects (the “Projects”) in the Athabasca Basin, Saskatchewan. The Waterbury East Project is located in the northeastern Athabasca Basin 25 kilometres northeast of the Cigar Lake Mine and covers 1,337 hectares (Figure 1). The Constellation Project is located in the southeastern Athabasca Basin 60 kilometres south of the Key Lake Mine and Mill Complex and covers 11,142 hectares (Figure 2).

Figure 1 – Waterbury East Project Location

Waterbury East Agreement

Bayridge may earn up to an 80% interest in the Waterbury East Project by undertaking work and payments in three defined earn-in stages. Bayridge may earn an initial 40% interest (Stage 1) in the Waterbury East Project by paying the Company $265,000 cash, issuing $370,000 of common shares of Bayridge and incurring $1,500,000 in exploration expenditures on the Project within 18 months of the date of the definitive agreement (the “Waterbury East Agreement Date”). Bayridge may earn an additional 20% interest for a total 60% interest (Stage 2) in the Waterbury East Project by paying to the Company a further $220,000 cash and issuing an additional $385,000 of Bayridge common shares concurrent with providing notice that it wishes to proceed with the Stage 2 earn-in, and by incurring a further $1,500,000 in exploration expenditures on the Waterbury East Project within 12 months of commencing the Stage 2 earn-in (approximately 2.5 years after the Waterbury East Agreement Date).

Bayridge may earn an additional 20% interest for a total 80% interest (Stage 3) in the Waterbury East Project by paying to the Company a further $275,000 cash and issuing an additional $550,000 of Bayridge common shares concurrent with providing notice that it wishes to proceed with the Stage 3 earn-in, and by incurring an additional $2,000,000 in exploration expenditures on the Waterbury East Project within 12 months of commencing the Stage 3 earn-in (approximately 3.5 years after the Waterbury East Agreement Date).

After successful completion of (a) Stage 1, if Bayridge elects to not enter the next stage or fails to make the Stage 2 option payments when and as required; or (b) Stage 2, if Bayridge elects to not enter the next stage or fails to make the Stage 3 option payments when and as required; or (c) Stage 3, a joint venture will be formed and the parties will either co-contribute thereafter on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. Any party diluting to a 10% interest will automatically forfeit its interest in the Project and in lieu thereof will be granted a 2% net smelter return royalty on the Project.

Constellation Agreement

Bayridge may earn up to an 80% interest in the Constellation Project by undertaking work and payments in three defined earn-in stages. Bayridge may earn an initial 40% interest (Stage 1) in the Constellation Project by paying the Company $225,000 cash, issuing $315,000 of common shares of Bayridge and incurring $1,500,000 in exploration expenditures on the Project within 18 months of the date of the definitive agreement (the “Constellation Agreement Date”). Bayridge may earn an additional 20% interest for a total 60% interest (Stage 2) in the Constellation Project by paying to the Company a further $165,000 cash and issuing an additional $290,000 of Bayridge common shares concurrent with providing notice that it wishes to proceed with the Stage 2 earn-in, and by incurring a further $1,500,000 in exploration expenditures on the Constellation Project within 12 months of commencing the Stage 2 earn-in (approximately 2.5 years after the Constellation Agreement Date).

Bayridge may earn an additional 20% interest for a total 80% interest (Stage 3) in the Constellation Project by paying to the Company a further $210,000 cash and issuing an additional $415,000 of Bayridge common shares concurrent with providing notice that it wishes to proceed with the Stage 3 earn-in, and by incurring an additional $2,000,000 in exploration expenditures on the Constellation Project within 12 months of commencing the Stage 3 earn-in (approximately 3.5 years after the Constellation Agreement Date).

After successful completion of (a) Stage 1, if Bayridge elects to not enter the next stage or fails to make the Stage 2 option payments when and as required; or (b) Stage 2, if Bayridge elects to not enter the next stage or fails to make the Stage 3 option payments when and as required; or (c) Stage 3, a joint venture will be formed and the parties will either co-contribute thereafter on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. Any party diluting to a 10% interest will automatically forfeit its interest in the Project and in lieu thereof will be granted a 2% net smelter return royalty on the Project.

Figure 2 – Constellation Project Location

All Bayridge shares issued to CanAlaska under both option agreements will be subject to a hold period expiring four months and one day after their date of issue pursuant to applicable Canadian securities laws. In addition, CanAlaska has agreed to voluntary resale restrictions on such shares whereby 25% of the shares will be released from voluntary resale restrictions 3, 6, 9 and 12 months after their issue date.

During all stages of both option agreements, Bayridge will be operator of the Projects and will be entitled to charge an operator fee. Bayridge will have deciding voting rights on annual exploration programs while sole funding at the various option stages.

An Area of Mutual Interest (“AMI”) will extend two kilometres from the outer boundary of the Projects, excluding all properties within such area that are currently held by CanAlaska at time of signing the definitive agreement.

Bayridge is currently conducting due diligence on the properties comprising the Projects. Upon successful due diligence, the parties will work towards finalizing and executing a formal agreement. The Company will provide updates on this transaction if and when they become available.

CanAlaska CEO, Cory Belyk, comments, “I am very pleased to be partnering with Bayridge to move these highly prospective projects forward toward discovery. With uranium prices above $100 per pound and with frequent long-term contracting, the uranium market is strengthening and building momentum. Global fuel supply challenges, dwindling reserves, and increasing demand are leading toward an incredible bull-run in the nuclear space that may be decades long. Through this investment by Bayridge, these underexplored eastern Athabasca Basin projects could deliver tier 1 assets that fuel the clean energy of the future. CanAlaska shareholders can expect significant news flow as these projects advance.”

About the Waterbury East Project

The Waterbury East Project is located in the northeastern Athabasca Basin, 25 kilometres northeast of the Cigar Lake Mine. The Project has approximately 200 metres of Athabasca sandstone cover overlying the basement rocks of the Wollaston Domain. The Project consists of 1 mineral claim covering 1,337 hectares.

Early exploration on the Waterbury East Project consisted of historical regional and project scale ground and airborne geophysical surveys, followed by focused prospecting and boulder sampling programs. CanAlaska acquired the Project in the early 2000’s through staking and completed property-wide airborne geophysical surveys, including GEOTEM and VTEM. The VTEM survey identified a 7 kilometre-long northeasterly-trending conductivity corridor coincident with an AIIP anomaly. Six drillholes were completed on the conductive corridor, with results highlighted by faulted and altered basement rocks with local uranium enrichment. Off property to the south, an AIIP anomaly of similar style and intensity is present on the Dawn Lake project that contains mineralized historical drillhole Q11A-006, which contains 7.2 metres @ 1.86% eU3O8 from 213.5 metres.

About the Constellation Project

The Constellation Project is located in the southeastern Athabasca Basin, 60 kilometres south of the present-day Athabasca Basin edge and the Key Lake Mine and Mill complex along Highway 914. The Project consists of 13 mineral claims for a total of 11,142 hectares.

Historical exploration on the Constellation Project consists of prospecting and geological mapping that were completed in conjunction with airborne radiometric, electromagnetic, and magnetic surveys. These historical surveys identified electromagnetic conductors associated with magnetic lows that flank magnetic highs, which is an analogous geological framework for Athabasca style uranium deposits. These geophysical surveys were followed by geological mapping and wide-spaced prospecting programs both on property and along trend to the south. Prospecting along trend identified outcrop-hosted high-grade uranium mineralization in Getty-Minerals Zones 2-6 and 2-3, located approximately 10 kilometres from the Project boundary. These showings returned uranium mineralization from grab samples in outcrop grading 2.787% U3O8 and 4.60% U3O8. The mineralized magnetic low corridor along which the Getty-Minerals Zones are hosted trends onto the Constellation Project. In the early 2000’s, geological mapping and geochemical sampling on the Project confirmed the magnetic high is a central core of Archean gneiss which is flanked by graphitic metasediments. In addition, structural lineaments in the magnetic lows were interpreted, and may represent large scale faulting. In total, the Constellation Project contains over 18 kilometres of untested prospective target area.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQX: CVVUF; Frankfurt: DH7) holds interests in approximately 500,000 hectares (1,235,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. For further information visit www.canalaska.com.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is Nathan Bridge, MSc., P. Geo., Vice-President Exploration for CanAlaska Uranium Ltd., who has reviewed and approved its contents.

On behalf of the Board of Directors

“Cory Belyk”

Cory Belyk, P.Geo., FGC

CEO, President and Director

CanAlaska Uranium Ltd.

Contacts:

| Cory Belyk, CEO and President | General Enquiry |

| Tel: +1.604.688.3211 x 138 | Tel: +1.604.688.3211 |

| Email: cbelyk@canalaska.com | Email: info@canalaska.com |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.